applsupport.ru

Learn

Can You Pay Grubhub In Cash

If your bank does not support Real Time Payments, you are still eligible to use Grubhub's Instant Cash Out feature. However, the process may. You can now use RebelCash to order food from Grubhub, 50% off your first You must use RebelCash as payment to get the Grubhub+ membership benefit. Yes, Grubhub does accept and allow customers to pay with cash. However, it is important to note that whether a restaurant accepts cash payments. You can request for the driver to text or call you once your order has been dropped off. Grubhub accepts payment by credit card, PayPal or a gift card. And a. If you choose to join Prime again, you will need to activate your free Grubhub+ benefits again by visiting applsupport.ru Who do I contact if I have an. GRUBHUB, AND I PAID CREDIT. When the food arrived, the guy says it was If you don't pay in cash, they charge you an extra fifty or seventy-five. Direct deposit. Get your balance sent directly to your bank account every Thursday. · Get paid instantly. Instant Cash Out whenever you want to your bank account. Even if you use a different payment method than your campus card and 1Card Cash, your Grubhub account is still eligible for Grubhub+ membership. Free delivery. If you have to use grubhub tip in cash, or better yet just don't tip. I don't care I am making the minimum hourly rate 99% of the time. If grubhub can't survive. If your bank does not support Real Time Payments, you are still eligible to use Grubhub's Instant Cash Out feature. However, the process may. You can now use RebelCash to order food from Grubhub, 50% off your first You must use RebelCash as payment to get the Grubhub+ membership benefit. Yes, Grubhub does accept and allow customers to pay with cash. However, it is important to note that whether a restaurant accepts cash payments. You can request for the driver to text or call you once your order has been dropped off. Grubhub accepts payment by credit card, PayPal or a gift card. And a. If you choose to join Prime again, you will need to activate your free Grubhub+ benefits again by visiting applsupport.ru Who do I contact if I have an. GRUBHUB, AND I PAID CREDIT. When the food arrived, the guy says it was If you don't pay in cash, they charge you an extra fifty or seventy-five. Direct deposit. Get your balance sent directly to your bank account every Thursday. · Get paid instantly. Instant Cash Out whenever you want to your bank account. Even if you use a different payment method than your campus card and 1Card Cash, your Grubhub account is still eligible for Grubhub+ membership. Free delivery. If you have to use grubhub tip in cash, or better yet just don't tip. I don't care I am making the minimum hourly rate 99% of the time. If grubhub can't survive.

You can start your delivery order straight from our app, or head to any of our official third-party partners, DoorDash, Grubhub, Postmates, and Uber Eats. Did you know that you can now use your UB Campus Cash and FlexiBULL Bucks on Grubhub? Whether you are on or off-campus you can use your Campus Cash or. If an order is pre-paid, tap on the check and then tap 'Close Out to Pre-Paid'. If an order will be paid with cash, tap 'Payments > Cash' to complete the. Yes, only orders placed from our on-campus restaurants will accept campus meal plans or Global Waves Cash. You can also pay using your personal credit or debit. Grubhub gives it to you straight. See the delivery fee upfront, before you start crafting the perfect food order. Pay your way with credit cards, Grubhub gift. Signing up for the service is easy and allows for several payment options, including dining plans, Hokie Passport funds, and credit and debit cards. How to Sign. UW-Green Bay has partnered with Grubhub so students, faculty and staff can order from off-campus restaurants using Phlash Cash with free delivery. Yes, Grubhub does accept and allow customers to pay with cash. However, it is important to note that whether a restaurant accepts cash payments through Grubhub. 1) Does Wendy's deliver in Cash? Yes, Grubhub does delivery for Wendy's in Cash so you can order all your favorite food online. · 2) How much do popular Wendy's. CAN I INSTANT CASH OUT $ PER WEEK? If you want to use GrubHub's 'instant cash out' feature, you can use the 'instant cash out' feature to withdraw up to. When in doubt, go for takeout—Grubhub has it all! Order food delivery from thousands of restaurants, including local spots and national chains. Did you know that you can now use your UB Campus Cash and FlexiBULL Bucks on Grubhub? Whether you are on or off-campus you can use your Campus Cash or. You can use Garnet Cash to pay for food ordered on GrubHub, simply by adding your OneCard to the GrubHub app. When you add your OneCard, you'll also receive. Did you know you can use your CrimsonCash to pay for orders from your favorite local restaurants on Grubhub? Even better, you'll get $0 delivery fees because. Grubhub also offers a cash payment option at checkout, though its availability may vary depending on the restaurant. Users can order food from a variety of. You can use Apple Pay or Google Pay, but a linked card is the easiest. Then you get to chill and let the McD's come to you. Try not to check the order tracker. CAN I INSTANT CASH OUT $ PER WEEK? If you want to use GrubHub's 'instant cash out' feature, you can use the 'instant cash out' feature to withdraw up to. Grubhub offers three ways of payment: Dining Dollars, Meal Exchange, and credit card. Know before you go! · Mobile check-in is required at Upstein Food Court. Cash this year to pay for Grubhub - you may still use Crimson Cash with Grubhub for the year! Did you know you can use your Crimson Cash. can order food delivery anytime from their favorite restaurants. Terms and Conditions. By using this gift card, you accept the following terms and conditions.

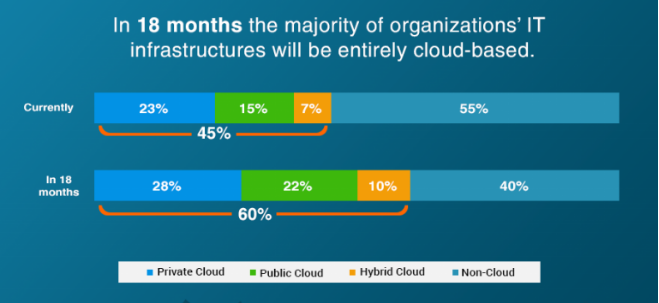

Cloud Adoption Statistics Gartner

The projected CAGR of 18% for public cloud services from to (Gartner) underscores sustained growth and adoption across industries, including those. Software as a Service - statistics & facts · Revenue from the public cloud market. bn USD · Largest SaaS market share region United States · Software as a. The cloud strategy must align, and not contradict, with the strategies for security, data center, edge computing, and development and architecture, as well as. Accelerated cloud adoption continues to enable enormous innovation across data management technologies, with some new disruptors like generative AI now entering. In , 60% of corporate data was stored in the cloud. This figure is expected to increase as cloud adoption becomes more widespread. Financial services firms, like organizations in all industries, store about 61% of sensitive data in the public cloud, on average. The average number of public. Gartner predicts the worldwide public cloud service market will grow from $B in to $B in , attaining a compound annual growth rate (CAGR). Top 12 Cloud Computing Facts: Statistics & Benefits for · Cloud usage grew 15% from last year, reaching an all-time high. · The worldwide public cloud. New development methods and control options are driving the evolution of cloud computing. Gartner estimates that by more than 50% of enterprise-managed. The projected CAGR of 18% for public cloud services from to (Gartner) underscores sustained growth and adoption across industries, including those. Software as a Service - statistics & facts · Revenue from the public cloud market. bn USD · Largest SaaS market share region United States · Software as a. The cloud strategy must align, and not contradict, with the strategies for security, data center, edge computing, and development and architecture, as well as. Accelerated cloud adoption continues to enable enormous innovation across data management technologies, with some new disruptors like generative AI now entering. In , 60% of corporate data was stored in the cloud. This figure is expected to increase as cloud adoption becomes more widespread. Financial services firms, like organizations in all industries, store about 61% of sensitive data in the public cloud, on average. The average number of public. Gartner predicts the worldwide public cloud service market will grow from $B in to $B in , attaining a compound annual growth rate (CAGR). Top 12 Cloud Computing Facts: Statistics & Benefits for · Cloud usage grew 15% from last year, reaching an all-time high. · The worldwide public cloud. New development methods and control options are driving the evolution of cloud computing. Gartner estimates that by more than 50% of enterprise-managed.

96% of respondents say that insufficient skilled security staff is affecting their ability to secure the usage of cloud computing, compared to 92% of. According to Gartner more than $ trillion in IT spending will be affected by the shift to cloud by , with predicted spending on system infrastructure and. According to the Gartner Research Centre, “not only is demand for cloud services reshaping the IT services industry, but it is also driving server spending up. 85 percent of enterprises have a multi-cloud strategy, up from 82% in (RightScale). By , Gartner anticipates that more than $1 trillion in IT spending. The number of large organizations with a multi-cloud strategy is predicted to rise from 76% to 85% during But while it offers cost and. Gartner have forecast spending to grow a further % in , reaching A commonly cited barrier to cloud adoption are data sovereignty regulations. The 5 Rs model was first introduced by Gartner in the early days of cloud computing when organizations were just beginning to explore the potential benefits of. Global network of AWS Regions. AWS has the most extensive global cloud infrastructure. The AWS Region and Availability Zone model has been recognized by Gartner. Converged single pass processing, purpose built global cloud service, and open data platform. adopt what Gartner calls “the future of network security”. However, the cloud infrastructure services market remains highly dynamic as Microsoft and Google compete with AWS for increased cloud spending. Gartner says. Cloud computing is a key component of IT, and businesses' reliance on it is growing. This is highlighted by Gartner's report, which projects an increase of. This report by Gartner provides essential guidance for Infrastructure and Operations (I&O) leaders on effectively leveraging public cloud. Software as a Service - statistics & facts · Revenue from the public cloud market. bn USD · Largest SaaS market share region United States · Software as a. This has led to a high adoption rate of cloud services across various industries, including healthcare, finance, and retail. Additionally, the US market is. Public Cloud Statistics · The global public cloud services market is projected to reach $ billion in , with a compound annual growth rate (CAGR) of applsupport.ru · applsupport.ru · https://www. Read the analyst report for estimates on industry adoption of S/4HANA and advice on how to move forward. · Quarterly S/4HANA adoption rates since · Breakdown. Gartner hints that technology providers should use indicators of growth in cloud adoption as a measure for market opportunity. They divide the. Gartner evaluated 20 top service providers that deliver managed cloud and professional services relating to infrastructure and platform operations globally, for. According to a report from Gartner, the global public cloud services market is expected to reach $ billion by , up from $ billion in

Trace Voip Text

VoIP Trace is a Cisco Unified Border Element (CUBE) serviceability framework, which provides a binary trace facility for troubleshooting SIP call issues. Use Twilio to build phone call tracking into your software. Start to measure Send and receive multichannel text and media messages in + countries. It is extremely difficult to trace a threatening text from a non-fixed VoIP. The phone number from which you received the text message may or may not be related. texts is to use the block number feature on your cellular phone. Check with telephone, (only in areas where Call Trace is available in Illinois). A. You can trace VoIP text by filtering the SIP packets, drilling down into the packet and see the text. It might be a SIP info packet that carries the text. A VoIP texting service or a Voice over IP text messaging service allows businesses to conveniently send and receive business text messages without the need for. A simple voip tracing: Cell Id —> MSC —> GMSC —> Gateway code —> ILD —> VoIP provider (Ignored switch and some minor infos). VoIP texts can potentially be traced, but the ability to do so depends on various factors such as the specific VoIP service being used or the level of. VoIP Trace is a Cisco Unified Border Element (CUBE) serviceability framework, which provides a binary trace facility for troubleshooting SIP call issues. VoIP Trace is a Cisco Unified Border Element (CUBE) serviceability framework, which provides a binary trace facility for troubleshooting SIP call issues. Use Twilio to build phone call tracking into your software. Start to measure Send and receive multichannel text and media messages in + countries. It is extremely difficult to trace a threatening text from a non-fixed VoIP. The phone number from which you received the text message may or may not be related. texts is to use the block number feature on your cellular phone. Check with telephone, (only in areas where Call Trace is available in Illinois). A. You can trace VoIP text by filtering the SIP packets, drilling down into the packet and see the text. It might be a SIP info packet that carries the text. A VoIP texting service or a Voice over IP text messaging service allows businesses to conveniently send and receive business text messages without the need for. A simple voip tracing: Cell Id —> MSC —> GMSC —> Gateway code —> ILD —> VoIP provider (Ignored switch and some minor infos). VoIP texts can potentially be traced, but the ability to do so depends on various factors such as the specific VoIP service being used or the level of. VoIP Trace is a Cisco Unified Border Element (CUBE) serviceability framework, which provides a binary trace facility for troubleshooting SIP call issues.

Voice Over Internet Protocol number is basically a virtual phone number that you can use like a regular phone to make conference calls and send SMS messages. Can you trace a VoIP number? All VoIP numbers are traceable, but most people don't go to the trouble unless there's a real need for it. There are many. can anyone help me trace a voip number that has been texting me for 5 years? I've been getting random text messages over the past five years. wireshark is a free packet sniffing tool that can be used to analyze SIP/VoIP packets. If you get a wireshark trace of the text message exchange then you can. VoIP calls can also be traced, but again, it is not as simple as just outlining a phone call. When a VoIP call is made, the data packets that. It is extremely difficult to trace a threatening text from a non-fixed VoIP. The phone number from which you received the text message may or may not be related. How to Track Phone Calls and Text Messages for Free? · 1. Use a Monitoring App · 2. Use a Free Phone Call Tracker · 3. Track Calls of Other Mobile Through iCloud. To trace the number on a SIP phone, you'll need a packet analyzer—a program that intercepts or logs network traffic. The packet analyzer's SIP filter will. debug vpm spi —This command traces how the voice port module service Text is "normal call clearing.", Last Setup Time = Matched: Hushed is the best second number app for Wi-Fi calling. Make private calls, send texts, and manage multiple numbers all on a single device. There is no support to track text messages or to associate incoming text messages to/from contacts or leads. It could easily be part of Activities, but it is. 3. Can VoIP numbers receive texts? Yes, your VoIP phone number can receive and send text messages. To do the same, you have to make sure that you have valid. Some people will try to track calls by searching phone books or via an identification service. But with non-fixed VoIP, even if you do find information this way. While sending texts to a VoIP number, ensure that their VoIP plan supports SMS and texting. Likewise, you can send texts from or receive texts to your VoIP. VoIP calls can be traced. VoIP incoming calls can even be traced after the call has ended by checking the server records and the associated data. Such. You can find the owner of an unidentified VOIP number through the service provider. The VOIP service provider should be able to track the owner of that phone. VoIP business phone numbers like voicemail services and text messaging. Some It may be possible to trace a call from a fixed VoIP phone linked to a. Program Wireshark is used for tracing the communication between devices interconnected by LAN. The devices (e.g. PBX connected with a GSM gateway via LAN). Keep track of your calls with VoIP analytics. Know your business Provide updates and quick replies via text messaging on your business number. You can find the owner of an unidentified VOIP number through the service provider. The VOIP service provider should be able to track the owner of that phone.

Forex Broker Free

Get familiar with trading in a real account before investing and take advantage of trading with leverage up to Get your FREE $50 Account in 3 easy steps. Explore our Swap-Free trading accounts, designed for traders seeking interest-free options compliant with Islamic principles at Fusion Markets. Register for free and validate your identity to receive $ in promotional credit! No deposit required, all profits* are withdrawable. Claim Your $ Bonus. Our guide provides an overview of the top swap-free account brokers in terms of spreads, markets offered, safety, minimum deposits, trading tools, and other. Discover OANDA, the smarter forex trading app. Download the free OANDA app in a few simple steps and start investing today. - Customize your platforms to. Test your FX trading strategies with this risk-free account, complete with $50, in virtual funds to trade currency markets. This way, the live markets can. Try our award-winning platform* for free with a forex demo account. Start developing your trading skills with tastyfx. Practice trading with $10, virtual. Don't miss out. Ebook: How to trade forex. Essential reading for all beginning traders. Free download. Get your $30 FREE Account in 3 easy steps. Promotion is available ONLY to New Clients for Prime Accounts with a USD, EUR, GBP & JPY currency base. Get familiar with trading in a real account before investing and take advantage of trading with leverage up to Get your FREE $50 Account in 3 easy steps. Explore our Swap-Free trading accounts, designed for traders seeking interest-free options compliant with Islamic principles at Fusion Markets. Register for free and validate your identity to receive $ in promotional credit! No deposit required, all profits* are withdrawable. Claim Your $ Bonus. Our guide provides an overview of the top swap-free account brokers in terms of spreads, markets offered, safety, minimum deposits, trading tools, and other. Discover OANDA, the smarter forex trading app. Download the free OANDA app in a few simple steps and start investing today. - Customize your platforms to. Test your FX trading strategies with this risk-free account, complete with $50, in virtual funds to trade currency markets. This way, the live markets can. Try our award-winning platform* for free with a forex demo account. Start developing your trading skills with tastyfx. Practice trading with $10, virtual. Don't miss out. Ebook: How to trade forex. Essential reading for all beginning traders. Free download. Get your $30 FREE Account in 3 easy steps. Promotion is available ONLY to New Clients for Prime Accounts with a USD, EUR, GBP & JPY currency base.

A commission-free account that is perfect for new traders looking to start applsupport.rurd accounts offer instant execution, stable spreads. Minimum. WikiFX Forex Rating lists Best Swap Free Account Forex Brokers (). Find more forex brokers ranking lists on WikiFX. This article explores why swap-free forex brokers are advantageous not only for Muslims but also for traders of all religions. Sign up and trade with the best forex broker! ▻ JustMarkets offers the Swap-free trading. No overnight charges for all clients. Open an FXCM forex and CFD demo account and practice forex trading risk free. Get live buy and sell prices, £50K of virtual money and access to trading. Find the best commission-free trading brokers in the US. Read our comprehensive guide to compare fees, features, and more. Experience Exness - the premier online trading platform. Enjoy seamless online trading with a trusted broker. Start trading online with confidence today. Free Forex Demo Trading Account. Enjoy Risk-Free FXCM Demo Account. Forex Trading Station Demo. Most Transparent Forex Broker Global Forex Awards Best In. FxPro offers CFDs on currency pairs and six other asset classes. Start trading forex online with the world's best forex broker. Free Demo Account · Create Live Account. Platforms and Tools. Our Trading Trade with a broker dedicated to your success. Unique resources designed to. Top 10 Forex Brokers (Tickmill, InstaForex, XM) with Free, Withdrawable Bonus Offers; Highest No Deposit Bonus Offers in Forex for Beginners. and much, MUCH. A commission-free account that is perfect for new traders looking to start applsupport.rurd accounts offer instant execution, stable spreads. Minimum. Fusion Markets is Australia's lowest cost Forex and CFD broker*, offering zero spread trading, hundreds of products and no minimum deposits. Sign up now. Hold your leveraged positions for as long as you like, swap-free. T&C apply Forex CFD · Commodities CFD · Stocks CFD · Indices CFD · Crypto CFD. Platforms. applsupport.ru offers a free € demo forex trading account with no risk or commitment. Open your free demo in seconds and practice your strategies. Zero spreads, low fees, zero requotes. No minimum distance order restriction. Advanced algorithmic trading features, cTrader Automate, free VPS. A list of Forex Brokers that offer Swap-Free (Rollover Free) accounts. These accounts do not charge swap (interest) on open positions held overnight. Unlike most MetaTrader platforms, you'll have free access to integrated Reuters news. Blue icon of finger pressing a button. Seamless experience. Tap into the. The Trendo broker has also taken steps in this direction and offers a free welcome bonus. This way, traders can start real Forex trading without risk and gain. Start trading. Swap-Free Trading Image. Swap-Free Trading to boost your profits. Trading starts with choosing your trading account. Start trading. MetaTrader 4.

Cost For Medical Coding Training

Online program cost is $ · Intermediate computer skills and high school diploma/GED diploma required. · Prior coding, medical terminology, anatomy and. Do the Math: ; $ cost per full-time credit ; x 36 total credits. $ Tuition Only $ down to get started. Click here to see upcoming dates. Authorized Training Licensed by the New York State Education Department. Duration: 80 hours · Dates: October 07, – January 22, · Days: Mondays and Wednesdays · Times: pm – pm · Location: Huntsville Campus · Cost. Cost Items ; Books (Estimated). $ ; Testing/Exam Fees. $ ; In-State/District Tuition. $4, ; Other Fees. $ AAPC Membership ; Registration Fee. Choose from 2 online medical billing and coding programs. Prepare for the CCS or CPC industry certification exams - a prep course and voucher for one exam fee. USCI is proud to offer an affordable program, costing only $1, total when you pay in full. Payment plans are also available and tuition includes your CBCS. Program Fee Overview ; $ · $ · $ · $ ; $ · $ · $ · N/A. A medical billing and coding training program certificate can cost $1, to $30, An associate degree is more expensive, and prices can go from $6, to. Online program cost is $ · Intermediate computer skills and high school diploma/GED diploma required. · Prior coding, medical terminology, anatomy and. Do the Math: ; $ cost per full-time credit ; x 36 total credits. $ Tuition Only $ down to get started. Click here to see upcoming dates. Authorized Training Licensed by the New York State Education Department. Duration: 80 hours · Dates: October 07, – January 22, · Days: Mondays and Wednesdays · Times: pm – pm · Location: Huntsville Campus · Cost. Cost Items ; Books (Estimated). $ ; Testing/Exam Fees. $ ; In-State/District Tuition. $4, ; Other Fees. $ AAPC Membership ; Registration Fee. Choose from 2 online medical billing and coding programs. Prepare for the CCS or CPC industry certification exams - a prep course and voucher for one exam fee. USCI is proud to offer an affordable program, costing only $1, total when you pay in full. Payment plans are also available and tuition includes your CBCS. Program Fee Overview ; $ · $ · $ · $ ; $ · $ · $ · N/A. A medical billing and coding training program certificate can cost $1, to $30, An associate degree is more expensive, and prices can go from $6, to.

You can take AAPC's online course for around $$ That also includes the cost of the certification exam. This % online course will prepare you to start a career in this high-demand occupation and earn the medical billing and coding professional certification. Gain medical coding and billing skills and college credits in just 8 weeks. $ course cost ($/credit); Upskill and earn college credits; % online, no. Completion of other coding training program to include anatomy & physiology, medical terminology, basic ICD diagnostic/procedural and basic CPT® coding. Apply. CareerStep's Medical Coding and Billing Professional program also includes the cost of the AAPC Practicode course you'll need to fast-track your path to full. Costs range from $$ AHIMA requires individuals to earn 20 continuing education units every two years to maintain their certification. Certification. You will need to plan for your education to cost anywhere between $6, and $50, for this degree. Type, Cost. Certificate / Diploma, $2, - $29, Q. How much does a Medical Coding and Billing Course cost? A. Depending on the program the cost can vary. USCI is proud to offer an affordable. The certified coding specialist (CCS) costs $ for AHIMA nonmembers and $ for members. Candidates need two years of work experience, or CCA certification. The Medical Coding Specialist Certificate costs $2, or take advantage of our installment payment option. With just a $ deposit, our new installment. You can take AAPC's online course for around $$ That also includes the cost of the certification exam. Take a look at all the reasons why TMT is right for you: Course Number: B Course Title: Medical Billing & Coding. Hours: (75 online, 45 classroom). hours. Cost: $ Medical Billing and Coding II. This course prepares students for entry-level medical billing and coding positions. Course topics can. The cost of instruction is based on $90 per credit hour. Some programs such as Professional Truck Driving may have a higher tuition. Does the cost of tuition. A medical billing and coding training program certificate can cost $1, to $30, An associate degree is more expensive, and prices can go from $6, to. Tuition/Fees/Financial Assistance. The Medical Billing and Coding Program cost is $2, (including all electronic program materials). This program is. The certificate program costs approximately $5, This amount includes in-state tuition, lab fees, books and supplies for the entire program. Does. Tuition: $1,* (total for all three courses) (Textbooks not included). * = Additional college registration and technology fees may apply. Textbooks can be. However, colleges typically charge between $4, and $19, for medical coding and billing certificates. Don't forget that sitting for certification exams. The cost of these exams is not included in the program cost: $ (per exam). Note: If you take both the coding and billing exams, the cost is $ Each exam.

Do Netflix Pay Dividends

Netflix annual common stock dividends paid for were $0B, a NAN% decline from Netflix annual common stock dividends paid for were $0B, a NAN%. Does Netflix, Inc. pay dividends? No, NFLX doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you. The current TTM dividend payout for Netflix (NFLX) as of August 30, is $ The current dividend yield for Netflix as of August 30, is %. Netflix (NFLX) Dividends. Read detailed company information including dividend distribution, dividend amount and payment history. Dividends & Splits ; Trailing Dividend Yield %, , ; Buyback Yield %, –, – ; Total Yield %, , Netflix (NFLX) Dividend Yield % as of today (August 21, ) is %. Dividend Yield % explanation, calculation, historical data and more. The company Netflix does not pay dividends yet, so we suggest that you How many Netflix's stocks do you need for receiving dividends? For receiving. Netflix stock? What is the week low for Netflix stock. Does Netflix stock pay dividends? What is Netflix stock price target? How to buy Netflix stock on. Netflix (NFLX) Dividend Payout Ratio as of today (August 19, ) is Dividend Payout Ratio explanation, calculation, historical data and more. Netflix annual common stock dividends paid for were $0B, a NAN% decline from Netflix annual common stock dividends paid for were $0B, a NAN%. Does Netflix, Inc. pay dividends? No, NFLX doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you. The current TTM dividend payout for Netflix (NFLX) as of August 30, is $ The current dividend yield for Netflix as of August 30, is %. Netflix (NFLX) Dividends. Read detailed company information including dividend distribution, dividend amount and payment history. Dividends & Splits ; Trailing Dividend Yield %, , ; Buyback Yield %, –, – ; Total Yield %, , Netflix (NFLX) Dividend Yield % as of today (August 21, ) is %. Dividend Yield % explanation, calculation, historical data and more. The company Netflix does not pay dividends yet, so we suggest that you How many Netflix's stocks do you need for receiving dividends? For receiving. Netflix stock? What is the week low for Netflix stock. Does Netflix stock pay dividends? What is Netflix stock price target? How to buy Netflix stock on. Netflix (NFLX) Dividend Payout Ratio as of today (August 19, ) is Dividend Payout Ratio explanation, calculation, historical data and more.

Netflix does not currently pay dividends to its shareholders. The company has chosen to reinvest its earnings back into the business for further growth and. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial. About the ability of Netflix Inc to maintain his current dividend of USD per share, an amount that accounts for %, we should study its payout ratio. Market CapB · Shares OutM · 10 Day Average VolumeM · Dividend- · Dividend Yield- · Beta · YTD % Change NFLX's dividend yield, history, payout ratio & much more! applsupport.ru: The #1 Source For Dividend Investing. Nasdaq Dow Other. Reinvest Dividends. Investment. Netflix Investors. Follow. Facebook · Twitter · Instagram · Linkedin · applsupport.ru · Terms of Use. Netflix's latest twelve months common dividends paid is zero · Netflix's common dividends paid for fiscal years ending December to averaged zero. Dividends made by Netflix from their annual profits Performance returns are based on hypothetical scenarios and do not represent an actual investment. Dividend Yield. %. Sector Median % ; Annualized Payout. -. Paid null ; Payout Ratio. -. EPS ; Growth Streak. - Years. Find the latest Netflix Inc (NFLX | USL) share dividend information plus latest price, news trades, performance, company information and news. Netflix (NFLX) stock — has never paid dividends, nor should it. NFLX pay dividend every six months, and most dividend paying companies do. Does Netflix pay dividends? How much is Netflix's dividend? When is Netflix ex-dividend date? When is Netflix dividend payment date? Does Netflix have. Netflix, Inc. (NFLX) last dividend date was on June 30, Dividends - $ per share, Dividend Yield is % and Total Shareholder Yield is %. As of October , Netflix has never declared or paid cash dividends since it went public. But, the question is whether a non-dividend paying stock is a bad. The previous NetFlix Inc (NFLX) dividend went ex over 14 years ago for 0c and was paid over 14 years ago. The next dividend is not expected in the near. Netflix's financials; How volatile are NFLX shares? Does Netflix pay a dividend? Have NFLX shares ever split? Other common questions. Our top picks for where. Some investments pay you profits or interest as you hold them. These payments are called dividends, and this value represents the dollar value as a percentage. Netflix does not pay a dividend to its shareholders. While Netflix is profitable and producing plenty of free cash flow today, that hasn't always been the case. Netflix (NFLX) stock — has never paid dividends, nor should it. NFLX doesn't pay yearly or quarterly or monthly dividends — none, no dividends at all. And.

Are Tax Returns Lower This Year

File Your IL, Individual Income Tax Return · Information for Claiming You may use our refund inquiry application to check the status of your current year. ADOR cannot determine, prior to the filing of a return, whether refunds will be offset for non-tax debts. lower your balance due,; shorten the term of. Reason 1: Changes to your income. Changes to your income last year may play a role in receiving a smaller refund this tax season. · Reason 2: The current. Calling Taxpayer Assistance will not speed up the processing of your return. We process more than six million individual income tax returns each year, and. Each filing season, the Office of Tax and Revenue sends back tax returns less than the amount of tax due when you actually file your return. Homeowner. and whom to contact for further information. If the debt is smaller than the refund, the taxpayer will receive the difference. Or gig workers who earned more income but didn't up their estimated payments may receive a lower refund at the end of tax season. Also, in some cases you may. Make your check or money order payable to the "DC Treasurer." Do not send cash. Write your Social Security number, daytime phone number, tax year of the return. See Instruction 10 in the Resident tax booklet for the reduced amounts, or review the page, Determine Your Personal Income Tax Exemptions. The additional. File Your IL, Individual Income Tax Return · Information for Claiming You may use our refund inquiry application to check the status of your current year. ADOR cannot determine, prior to the filing of a return, whether refunds will be offset for non-tax debts. lower your balance due,; shorten the term of. Reason 1: Changes to your income. Changes to your income last year may play a role in receiving a smaller refund this tax season. · Reason 2: The current. Calling Taxpayer Assistance will not speed up the processing of your return. We process more than six million individual income tax returns each year, and. Each filing season, the Office of Tax and Revenue sends back tax returns less than the amount of tax due when you actually file your return. Homeowner. and whom to contact for further information. If the debt is smaller than the refund, the taxpayer will receive the difference. Or gig workers who earned more income but didn't up their estimated payments may receive a lower refund at the end of tax season. Also, in some cases you may. Make your check or money order payable to the "DC Treasurer." Do not send cash. Write your Social Security number, daytime phone number, tax year of the return. See Instruction 10 in the Resident tax booklet for the reduced amounts, or review the page, Determine Your Personal Income Tax Exemptions. The additional.

Through this program, federal refunds may be reduced to offset certain past-due debts, including state income tax obligations. Each year, DOR goes. When and how do I file my North Carolina income tax return? If you file your return on a calendar year basis, the return is due on or before April. Unfortunately for many tax filers, this year's refund will yield a significantly smaller return than the previous two years due to a few different factors. tax refunds are issued to the correct individuals. These additional measures may result in tax refunds not being issued as quickly as in past years. Income Tax. If you filed your return before its due date, the IRS considers it filed on the due date. If you had income tax withheld or paid estimated tax during the year. The IRS has announced that it will begin accepting income tax returns related to tax year beginning Monday, January 29, Generally, a person or business has four years from the date on which the tax was due and payable to make a refund claim. However, the statute of limitations . Other Virginia state agencies and courts; Local Virginia governments – cities, towns, or counties; The IRS; Some federal government agencies (non-tax debts). tax return in the previous year. Taxpayers who need this information to NOTE: If you collected $30, or less in New Jersey Sales and Use Tax in. The amount of the premium tax credit you used during the year. (This was paid directly to your health plan so your monthly payment was lower.). Pennsylvanians have the option to submit PA Personal Income Tax returns online with the Department of Revenue's myPATH system. Credit is available to lower. In most cases, the IRS takes part of your refund to pay for outstanding government debts you might owe. These include: Overdue federal tax debts; Past-due child. Previously-issued Tax Year income tax refunds will not reduce or otherwise impact your 62F refund, and your receipt of a 62F refund has no bearing on. What's New This Tax Year · Individual Tax We usually process electronically filed tax returns the same day that the return is transmitted to us. Pay the IRS Less Without Going to Jail · Tax Webinars You can only get information on the Individual Income Tax Return for the current filing year. Improve your tax filing experience this season with these tips and reminders: These credits, which can provide cash-back or lower any tax you might owe. IRS levies on individual income tax refunds. Why is My Refund Being You will need to have your name, social security number the tax year; filing. You can use this Benefit Statement when you complete your federal income tax return to find out if your benefits are subject to tax. Employment during the year Income lower than or equal to $64, Persons with disabilities. Limited English-speaking taxpayers. Free Tax Return. You can do a year-end tax checkup to see if you have enough credits and withholding to cover your taxes. You may still have time to make adjustments to lower.

When Is Best Time To Buy A Vehicle

The simple answer is 'yes,” timing is important, and buying a new car or truck at the right time can save hundreds or literally thousands of dollars. The months of April through September are better discounted months, while the fourth quarter will always have the best deals. The discounts on vehicles. The best time to buy a car typically coincides with the ends of sales cycles — the last days of the month, quarter, or fiscal year. More specifically, January is considered as the best month to buy a car as it is the beginning of a new year and all the dealers are looking to offload the old. The absolute best time to buy a new car is December 26thst. Firstly, incentives and rate specials will literally never be stronger. The Best Time to Buy a Used Car. The best time to buy a used car is between Thanksgiving and the first week of January. Used car prices tend to go through a. While there are exceptions to every rule, experience shows that you are more likely to get a great deal on a new car towards the end of the day, just as the. Year-end sales events, three-day holiday weekends, and the end of each month have traditionally been the best times to get great deals on a new car. These are. However, if you're in urgent need of a new set of wheels, the end of the year is often one of the best times to buy, thanks to clearance sales offered by. The simple answer is 'yes,” timing is important, and buying a new car or truck at the right time can save hundreds or literally thousands of dollars. The months of April through September are better discounted months, while the fourth quarter will always have the best deals. The discounts on vehicles. The best time to buy a car typically coincides with the ends of sales cycles — the last days of the month, quarter, or fiscal year. More specifically, January is considered as the best month to buy a car as it is the beginning of a new year and all the dealers are looking to offload the old. The absolute best time to buy a new car is December 26thst. Firstly, incentives and rate specials will literally never be stronger. The Best Time to Buy a Used Car. The best time to buy a used car is between Thanksgiving and the first week of January. Used car prices tend to go through a. While there are exceptions to every rule, experience shows that you are more likely to get a great deal on a new car towards the end of the day, just as the. Year-end sales events, three-day holiday weekends, and the end of each month have traditionally been the best times to get great deals on a new car. These are. However, if you're in urgent need of a new set of wheels, the end of the year is often one of the best times to buy, thanks to clearance sales offered by.

The top three months with the highest percentage of used car deals are January (%), February (%), and December (13%). December is the best time to buy a car. It's enough that dealerships are generally emptier during the holidays due to people traveling, but sales teams have. Often, the best rate is available when the manufacturer is offering special rates. If you are not looking to purchase a new car during a sales event, or are. New Year's Eve and the New Year's Day holiday are some of the best times to buy a new or used car. The days are typically packed with special end-of-year sales. The best time to buy a car is in late December when yearly, quarterly, and monthly sales goals converge. The best time to buy a car typically coincides with the ends of sales cycles — the last days of the month, quarter, or fiscal year. Some days and months of the year are more likely to bring used car deals. We break down the best and worst times to shop for a used. The best time of year to buy a car are: Tax season, Memorial Day Weekend, Labor Day Weekend, and End Of Year. Save money on a car! The best times to buy a truck will generally be when the dealership is trying to move their product as quickly as possible. The months preceding a new financial quarter (February, May, August and November) are good months if you are looking for a deal, as dealers will want a strong. If you're looking to buy a used car and get the best deals, waiting it out through the spring and summer can be a good bet. The benefits of waiting to buy a. The best time to buy a used car is going to vary by region and may depend not only on your budget but the make, model, and year of the car as well. Typically the end of the calendar year can be a good time to save money on a new car, as that is a time when many car dealers are looking to meet their annual. Most car dealership sales employees have a big, year-end quota they have to meet. If possible, wait until December to visit a dealership. The Best Time of Year to Buy a Used Car or Truck · Always Buy Before You Need It · In The 4th Quarter of the Calendar Year · Front End of the Week · During. The best time to buy a car is towards the end of summer through the end of the year! Dealerships are making more room for the newer models on their lots. The months preceding a new financial quarter (February, May, August and November) are good months if you are looking for a deal, as dealers will want a strong. The Best Time to Buy a Used Car. The best time to buy a used car is between Thanksgiving and the first week of January. Used car prices tend to go through a. The Best Time of Year to Buy a Used Car or Truck · Always Buy Before You Need It · In The 4th Quarter of the Calendar Year · Front End of the Week · During. The best times to buy a truck will generally be when the dealership is trying to move their product as quickly as possible.

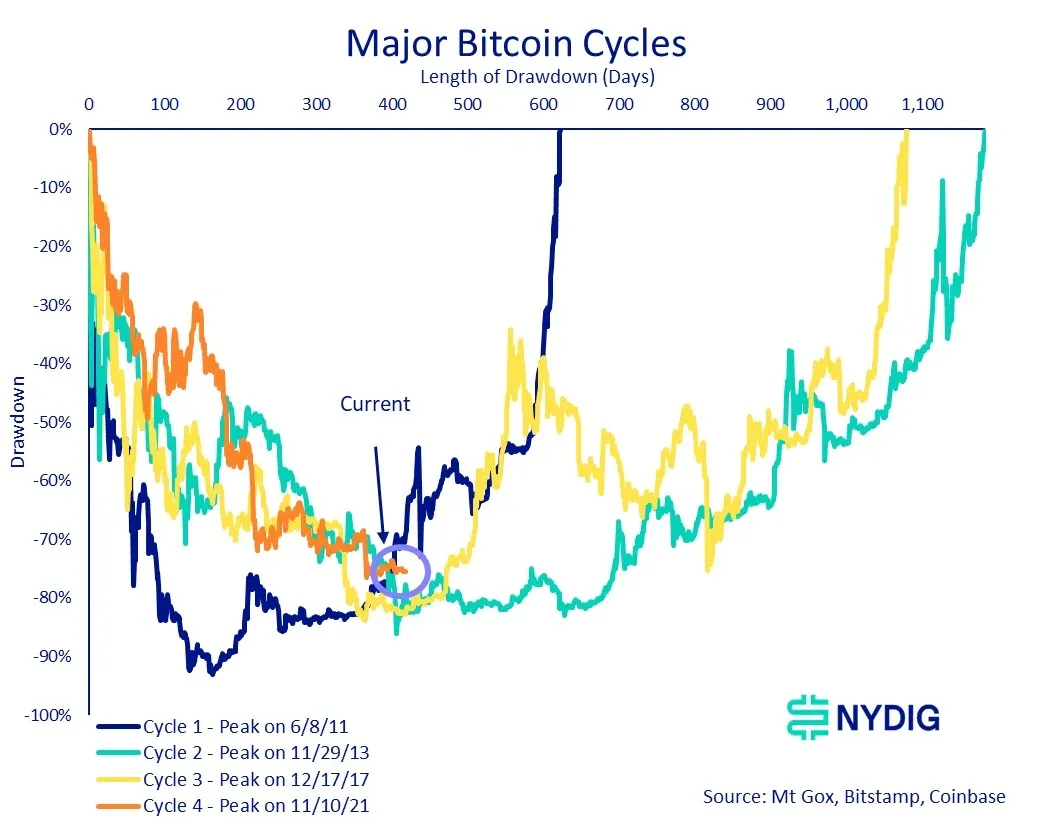

Nydig Aum

NYDIG is a vertically integrated bitcoin financial services and infrastructure firm committed to market-leading regulatory compliance and operational. AUM for Portfolio Advisors, LLC is measured as adjusted reported value plus unfunded commitments. FS Investments' calculation of AUM may differ from the. NYDIG is a leading technology and financial services firm dedicated to Bitcoin. NYDIG is the Bitcoin subsidiary of Stone Ridge, an $11 billion alternative. NYDIG, a bitcoin services company announced today “a $ million growth capital assets under management (AUM) also participated in the funding round. NYDIG is a leading technology and financial services firm dedicated to Bitcoin. NYDIG is the Bitcoin subsidiary of Stone Ridge, an $11 billion alternative. Viridi Fund's RIGZ Mining ETF Reaches AUM Milestone of $10 Million. 7 October Read More · Luxor Technology Closes $M Round Led by NYDIG, With. NYDIG is a technology and financial services firm dedicated to Bitcoin for institutions, private clients, and banks. The firm offers asset management. Our sister company, NYDIG, offers vertically integrated institutional bitcoin services including secure custody and risk-focused, bespoke financial services. Founded in Q4 of , NYDIG Asset Management is a New York-based hedge fund manager. The firm has a core focus on cryptocurrencies, specifically investing. NYDIG is a vertically integrated bitcoin financial services and infrastructure firm committed to market-leading regulatory compliance and operational. AUM for Portfolio Advisors, LLC is measured as adjusted reported value plus unfunded commitments. FS Investments' calculation of AUM may differ from the. NYDIG is a leading technology and financial services firm dedicated to Bitcoin. NYDIG is the Bitcoin subsidiary of Stone Ridge, an $11 billion alternative. NYDIG, a bitcoin services company announced today “a $ million growth capital assets under management (AUM) also participated in the funding round. NYDIG is a leading technology and financial services firm dedicated to Bitcoin. NYDIG is the Bitcoin subsidiary of Stone Ridge, an $11 billion alternative. Viridi Fund's RIGZ Mining ETF Reaches AUM Milestone of $10 Million. 7 October Read More · Luxor Technology Closes $M Round Led by NYDIG, With. NYDIG is a technology and financial services firm dedicated to Bitcoin for institutions, private clients, and banks. The firm offers asset management. Our sister company, NYDIG, offers vertically integrated institutional bitcoin services including secure custody and risk-focused, bespoke financial services. Founded in Q4 of , NYDIG Asset Management is a New York-based hedge fund manager. The firm has a core focus on cryptocurrencies, specifically investing.

assets under management (AUM). Bitcoin funds AUM Global BTC fund AUM | Source: NYDIG. Notably, $ billion of this AUM is invested in spot products. Although it's less well known than its rivals, Coinbase or Kraken, NYDIG has more than $4 billion in assets under management and operates a business that spans. The NYDIG Bitcoin Strategy Fund II seeks capital appreciation. The Fund pursues its investment strategy primarily by investing in bitcoin futures contracts and. Founded in Q4 of , NYDIG Asset Management is a New York-based hedge fund manager. The firm has a core focus on cryptocurrencies, specifically investing. NYDIG, Stone Ridge Asset Management's digital assets vertical, announced today that it had closed a $ million round from a group of institutional investors. NYDIG is a technology and financial services firm dedicated to Bitcoin for institutions, private clients, and banks. The firm offers asset management. assets under management, and CEO of New York Digital Investment Group. NYDIG"), Stone Ridge's regulated digital asset subsidiary. In addition to. NYDIG is a holding company that has led the creation of forward Over $10bn AUM, Cannot disclose at this stage. What type of family office are. Source: BlackRock is the world's largest ETF manager by AUM, managing $T in ETF investment vehicles as of Dec. 7 Source: NYDIG “Banking + Bitcoin Survey”. NYDIG. Sort through NYDIG alternatives below to make the best choice Remarkably, it's the sole fixed-price custody solution without AUM fees. Our. NYDIG provides digital financial services. It offers a full suite of institutional-grade digital asset prime brokerage, execution, and custody services. NYDIG says it has raised nearly $ million for its Institutional Bitcoin Fund. A total of 59 investors contributed to the raise. To learn more, click on the button that will lead you to a new link. ~$60B+ AUM. M Shares executed per our Securities platform daily. + Companies in Two. AUM statistics to be proportional. Despite robust trading volume for ETH ETFs, both volume and total fund flows still fell short of BTC ETFs. Public filings of Arcadia NYDIG Investors LP raised by Arcadia Investment Partners LLC. Direct links to the EDGAR source material. Track the AUM, funds, and holdings for NYDIG Digital Assets Fund V, LP over time. View the latest funds and 13F holdings. Compare against similar firms. NYDIG provides digital financial services. It offers a full suite of institutional-grade digital asset prime brokerage, execution, and custody services. NYDIG is a vertically integrated bitcoin financial services and infrastructure firm committed to market-leading regulatory compliance and operational. NYDIG's Post. View organization page for NYDIG, graphic. NYDIG AUM bought exposure to Bitcoin ETFs worth approximately $4 million in Q1. NYDIG has raised $ million for its institutional BTC fund, betting big assets under management. In December , NYDIG successfully raised $1.

S179 Deduction

May a taxpayer file a Wisconsin franchise or income tax return which reflects a section expense deduction amount different than the amount claimed on the. The tax benefits provided under IRS Section , allow many small businesses to write off the entire purchase cost of one or more qualifying new Ford trucks or. The section deduction allows taxpayers, other than trusts and estates, to elect to expense a specified amount of the cost of qualifying property. Section depreciation deduction Section of the United States Internal Revenue Code (26 U.S.C. § ), allows a taxpayer to elect to deduct the cost of. Heavy Vehicles - Land Rover SUVs Under 14, pounds. Most of our Land Rover SUV options fall under the "heavy" category for Section purposes, which means. The Section tax deduction lets you deduct all or part of the cost of your vehicle in the first year you use it for business, so long as it qualifies for. Section of the IRS tax code allows businesses to deduct up to the full purchase price of qualifying equipment and/or software purchased or financed during. All businesses that purchase, finance, and/or lease new or used business equipment during tax year should qualify for the Section Deduction. Any cost so treated shall be allowed as a deduction for the taxable year in which the section property is placed in service. (b) Limitations. (1) Dollar. May a taxpayer file a Wisconsin franchise or income tax return which reflects a section expense deduction amount different than the amount claimed on the. The tax benefits provided under IRS Section , allow many small businesses to write off the entire purchase cost of one or more qualifying new Ford trucks or. The section deduction allows taxpayers, other than trusts and estates, to elect to expense a specified amount of the cost of qualifying property. Section depreciation deduction Section of the United States Internal Revenue Code (26 U.S.C. § ), allows a taxpayer to elect to deduct the cost of. Heavy Vehicles - Land Rover SUVs Under 14, pounds. Most of our Land Rover SUV options fall under the "heavy" category for Section purposes, which means. The Section tax deduction lets you deduct all or part of the cost of your vehicle in the first year you use it for business, so long as it qualifies for. Section of the IRS tax code allows businesses to deduct up to the full purchase price of qualifying equipment and/or software purchased or financed during. All businesses that purchase, finance, and/or lease new or used business equipment during tax year should qualify for the Section Deduction. Any cost so treated shall be allowed as a deduction for the taxable year in which the section property is placed in service. (b) Limitations. (1) Dollar.

The Section tax deduction gets its name from Section of the IRS Tax Code. This section of the Tax Code states that businesses may deduct up to the full. A business can deduct up to $1 million in the year the equipment is first bought or leased. Bonus deductions are available until for equipment that exceeds. A business can deduct up to $1 million in the year the equipment is first bought or leased. Bonus deductions are available until for equipment that exceeds. Section allows businesses to deduct the expense of some assets – all of it – in the first year of use. Not all property qualifies for Section , but what. Section of the United States Internal Revenue Code (26 U.S.C. § ), allows a taxpayer to elect to deduct the cost of certain types of property on. Section lets your company buy equipment, vehicles, or vehicle accessories and deduct the entire purchase price from your gross income for the current tax. This is the section deduction. You can elect the section deduction instead of recovering the cost by taking depreciation deductions. Page Section allows you to elect to deduct all or part of the cost of certain qualifying property in the year you place it in service. The Section deduction is easy to apply. It gives businesses an incentive to invest in equipment and software to boost efficiency, raise productive capacity. The Section deduction limit for was raised to $ and the total equipment purchase limit was raised to $ This is an increase from the. Add-back = (Deduction on Federal Return – Deduction Using North Carolina Dollar and Investment Limitations) X 85%. A taxpayer may deduct 20% of the total amount. The amount of the section expensing deduction is equal to the cost of the section property for which the taxpayer elects to take the deduction, subject. Section of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the. You might be able to deduct its entire cost during the first year of use. This is called a Section deduction, also (erroneously) called Section Section allows you to write off % of the equipment cost rather than depreciating it over several years. Under section of the Internal Revenue Code, taxpayers can deduct from their federal income tax the cost of qualifying property used in a trade or business. Section limits · Value limit: All companies that lease, finance or purchase business equipment valued at less than $3,,0qualify for the. Section is a tax deduction, which allows businesses to subtract the cost of certain types of assets from their balance sheet. Heavy Vehicles - Land Rover SUVs Under 14, pounds. Most of our Land Rover SUV options fall under the "heavy" category for Section purposes, which means. The tax deduction cars include both new and used vehicle purchases, but you can also use it to buy software for your business.